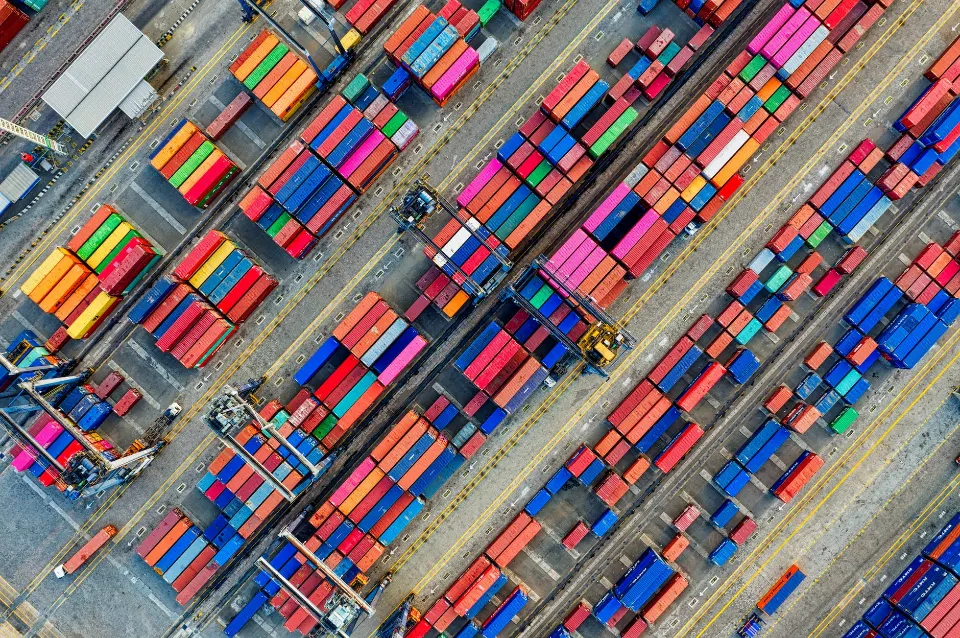

Insurance for shipping means avoiding extra expenses brought on by the loss or damage of packages and goods.

Lost, damaged, or porch pirated packages are nothing new to customers or businesses. Additionally, there are more dangers to packages in transit due to the e-commerce industry’s continued growth. What steps can your company take to reduce these risks? How does shipping insurance work and what are the advantages? In this blog, you’ll discover all the solutions you require.

What is Shipping Insurance?

Your company can purchase shipping insurance, which can offer coverage for packages that are misplaced, harmed, or stolen from a porch while being transported. Loss or damage is covered by shipping insurance up to the insured value of the goods plus shipping costs. Your policy can be customized to meet the needs of your company based on the products you ship, how you ship them, and the carriers you employ. It can also include coverage for expensive, fragile, time-sensitive, or perishable items. Even better, your company can let customers choose which purchases to pay for.

What is the Alternative to Shipping Insurance?

Many companies only use declared value/carrier liability to safeguard their goods. Declared value/carrier liability is not true insurance, which is a fact that many businesses may not be aware of.

In the event of loss or damage to a shipment (for example, theft), the carrier’s standard liability is to make good on its promises. up to $100 for small package, or $25/lb. for LTL). Excess liability is excess-value insurance (e.g., more than the carrier’s standard liability), up to the cost of the shipment. Small-print clauses and a complex web of governing laws, some of which go back to the 1930s, form the foundation of carrier liability. The statutes permit carriers to restrict their exposure and exempt a number of circumstances from their liability.

When it comes to carrier liability, the onus is on the shipper to demonstrate that the loss or damage happened while the goods were in the carrier’s actual physical control. Hidden damage is not covered by carrier liability. Furthermore, filing a claim can be a time-consuming and difficult process.

5 Benefits of Shipping Insurance

Comprehensive Coverage

With shipping insurance, you won’t have to worry about whether or how much your packages are covered. With the freedom to specify the value you want to cover, you can be sure that your shipments are secure. Moreover, you can choose coverage restrictions based on SKU, order value, or location. You can feel secure knowing your packages are covered even if you are shipping expensive, fragile, urgent, or perishable items.

Full Reimbursement and Expedited Reshipment

51% of small and medium sized businesses (SMBs) cited financial loss resulting from shipping replacement goods as one of their biggest challenges. Customers anticipate that businesses will address problems as soon as they arise. 38% of consumers are likely to fault the company they purchased from for any shipping issues. The good news is that you can quickly ship replacement goods, issue a refund, or give your customer a credit with shipping insurance because it will reduce the risk to your bottom line and help cover associated costs.

Quick and Easy Claims

Businesses may experience significant pain points related to the claims process when it comes to shipping, with 65% of SMBs citing a protracted claims process as their top source of annoyance. With InsureShield shipping insurance you can easily file a claim online and, if approved, have the claim paid in days not weeks1.

Peace of Mind

With shipping insurance, your company can benefit from a simple claims procedure as well as the peace of mind that comes from knowing your merchandise is covered up to the full retail value. More than 70% of SMBs think that having insurance will help them offer better customer service. Offer a top-notch shipping experience to keep your regular customers. You can enjoy both business and customer peace of mind, which is the best of both worlds.

Bottom Line Protection and Reputation Protection

37% of consumers are unlikely to buy from an SMB once more if they have problems with the shipping process, which could cost them $56 billion in lost yearly sales. But by making the shipping process better for customers, businesses can make up $35 billion in potential lost sales. Your company can safeguard both its reputation and financial well-being with shipping insurance.

When to Purchase Shipping Insurance?

The decision to purchase shipping insurance is influenced by a number of variables, such as the value of the shipment, whether it will be shipped domestically or internationally, and carrier policies. The decision to buy it can be aided by a few general guidelines, though.

First, it is more likely that insurance will be beneficial the more valuable the contents are. For high-value items, include markup to cover shipping insurance in your pricing. By giving your customers the option to purchase additional insurance at the time of purchase, you can also give them the final say.

When it costs you less to purchase insurance on each item and file claims when things are lost or damaged than it does to simply replace the items, that is when this protection is a good value.

FAQs

How Does Shipping Insurance Work?

Loss or damage is covered by shipping insurance up to the insured value of the goods plus shipping costs. In addition to including coverage for high-value, fragile, time-sensitive, or perishable goods, your policy can be customized to your business’s needs based on the products you ship, how you ship them, and the carriers you use.

Why Do I Need Shipping Insurance?

The ability to receive relief and insurance from shipping insurance makes it crucial. You won’t have to stress too much if the item is lost or damaged while traveling. It can aid in ensuring that you receive the profits from your sales that you are due.

Who is Responsible for Shipping Insurance?

Although all carriers carry liability insurance, you should still consider purchasing additional coverage.

What is Insurance in Shipping Company?

Marine insurance covers any loss or damage to ships, cargo, terminals, and any other mode of transportation used to move the property between its points of origin and its destination.